In early 2009, I hosted a small get together at the Oyster Bar in NYC, which was near my apartment. I was celebrating getting a book deal for what became 168 Hours. One of my guests was Emma Johnson, a woman I knew through freelance writing circles. I was somewhat annoyingly evangelistic about the 168 Hours message — that there is plenty of time in a week to build a big career and spend oodles of hours with family too. Emma’s toddler daughter was about the same age as my son, but she noted that she was moving in a different direction, trying to minimize hours worked. Indeed, we had a conversation about how she wasn’t interested in working much; her husband had a great job, and he traveled a lot internationally, and so it was best for her to be mostly at home with her daughter.

In early 2009, I hosted a small get together at the Oyster Bar in NYC, which was near my apartment. I was celebrating getting a book deal for what became 168 Hours. One of my guests was Emma Johnson, a woman I knew through freelance writing circles. I was somewhat annoyingly evangelistic about the 168 Hours message — that there is plenty of time in a week to build a big career and spend oodles of hours with family too. Emma’s toddler daughter was about the same age as my son, but she noted that she was moving in a different direction, trying to minimize hours worked. Indeed, we had a conversation about how she wasn’t interested in working much; her husband had a great job, and he traveled a lot internationally, and so it was best for her to be mostly at home with her daughter.

I think I grumbled at this (again, probably in that annoying new mom way of taking all comments about life choices personally). After all, my husband had a good job too, and traveled internationally, and yet I really wanted to “lean in,” despite this not being a phrase we used in 2009. We left it at that, agreeing to disagree.

Little did either of us know that Emma was about to become a poster child for the importance of keeping your career going no matter what.

Later that spring, she and I were in the ballroom at the Roosevelt Hotel in NYC for the annual American Society of Journalists and Authors conference. I saw her look at her phone, and she went out in the hall to take a call. After that, she disappeared. We were supposed to have dinner that night with a group; she never showed. She sent a note the next morning explaining that her husband, while on assignment in Greece, had fallen off a cliff and suffered a severe brain injury. Emma and her young daughter had taken off the previous evening for Athens, and she planned to be there for a while.

Her husband lived, and seemed to recover. But his injuries turned out to be more problematic on a psychological level than Emma first thought; his personality changed in some difficult ways. Meanwhile, in the excitement of his living through the ordeal, they decided to have a second child. It didn’t keep the marriage together. Her husband wound up leaving her while she was pregnant. He wasn’t really able to work in his old capacity, so she wound up getting very limited child support.

So there she was, broke, with two small children, realizing she needed to scale up her earnings fast.

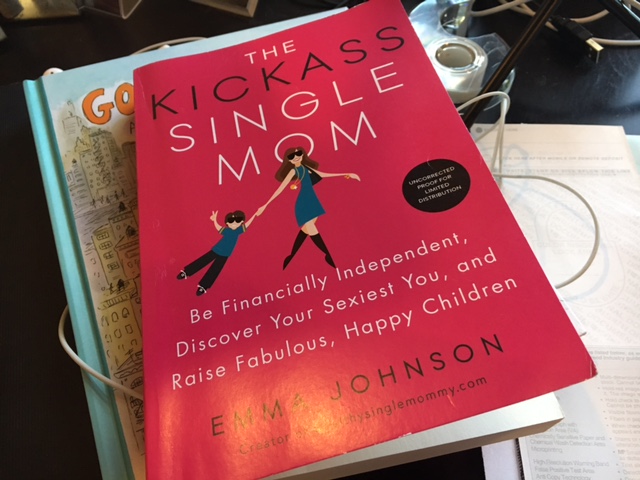

Her book about how she did so, and how she learned to build a rich and full life for her two children, and for herself, comes out today. As she’s talked about, it’s fortunate that she had the 12 or so hours a week she was working to fall back upon. She could scale up some of those clients, and use the connections she had because of that work to find new ones. If she hadn’t had that available to her, scaling up would have been a lot harder. But because the work she had gave her breathing room, she could then figure out what she wanted to do, and her Wealthy Single Mommy brand is the result.

The truth is, in life, you just never know. Part of doing your best for your kids is thinking about how you would support them. You. On your own. Because life can happen.

Emma and her husband both came from families that had experienced divorce. They vowed they would do things differently.

Things seemed to be going well, but no one can predict accidents or other trauma, and how people change in the aftermath.

They had savings, but if you’ve got joint accounts, it’s hard to keep one party from draining them. Or a messy divorce might introduce its own expenses.

Your partner might have a good job, but not be able to keep that job. Even if he/she does, you’re relying on a family court to award an adequate amount of child support, and you’re relying on your ex to pay it in a timely manner. Neither of these happen anything close to 100 percent of the time.

I’m so proud of the business Emma has built in the years since that phone call at the conference. And her book is really good! It’s hilarious — with a few juicy details of her post-divorce love life that are whoa. (I’m still laughing about her explanatory comment about a Danish man who accompanied her to a party — he wasn’t her boyfriend, he was her lover. And there was that outdoors hook-up after a neighborhood shindig…). While that might no be how everyone would approach dating in mid-life, her absolute refusal to blame or be bitter is inspiring. Indeed, she and her ex have a pretty good co-parenting relationship at this point, as his recovery has progressed and he’s been able to take on more with the kids.

But anyway, her experience has always been in the back of my mind. If a parent wants to stay home with a child, that can be a great choice, but if you neglect your earning capacity, you are leaving your kids vulnerable. It’s worth spending some time figuring out how to shore up those vulnerabilities. It’s worth maintaining your professional network, any professional licenses, and taking on a few projects here and there. Kids need time and money. Part of smart parenting is figuring out how you might be able to give them both.

Recently, a very close friend of mine ran into a similar situation. She married and had three children. He was a pharmacist and his income was sufficient that she could stay home if she chose. She chose to do so. However, she always kept her teaching license up to date just in case. After 16 years of marriage, her husband suffered macular degeneration (he was going blind) and the medicine that was used had a negative side effect that medicine was that it caused him kidney failure. He is now unable to work because of his dialysis schedule and overall health. Thankfully, she did keep her license up to date and was able to land a position at the local high school because she is the primary breadwinner now.

@Jennie- a good reminder that no one’s health is assured. And while life insurance and disability insurance can certainly play a role in being prepared for things to go wrong, it’s good to have a lot of options at one’s disposal. I’m so glad your friend was able to go back to work and make it work.

As someone who went through a divorce (luckily there were no children involved), I wholeheartedly agree. I really hate when people say “divorce is not an option” with regards to their marriage–I’m a huge fan of working through issues and I take marriage very seriously, but there are two people in a marriage. You can’t control the other person. People change (sometimes drastically, and not always due to a brain injury), situations change, the unexpected happens. No one gets married expecting to get divorced, and I would wager that a large percentage of divorces are a big surprise to at least one member of the marriage. And as Emma’s example proves, working “less” doesn’t have to mean “not working at all.”

And honestly, even if divorce was literally NOT an option (though I completely agree with you, never say never), death is certainly on the table for all of us, plans notwithstanding.

@Caitlin – yep, there are all kinds of ways to work. I agree that if someone’s partner has a great high paying job with health insurance and other such benefits, then no, one doesn’t need to work 40 hours a week (if he/she wants to, great! But certainly one doesn’t have to). But there is a vast space between full time, and basically retired. It’s wise to stay in there somewhere.

This is one thing my mother always instilled in me and my sister—we need to be able to support ourselves always because you never know what life will bring. As I get older I see more and more women in this unfortunate situation either due to illness, divorce, disability.

@Ana- a very good lesson to teach girls. And I think it has to be actively taught, given all the other Prince Charming stuff they encounter in the rest of the cultural narrative.

This is SUCH an important message. In fact, reading 168 Hours about 6 years ago, when my son was a year old, is what helped me realize I could (and should) go back to work. I’m a military spouse, and that comes with its own set of self-sufficiency issues. Not only could something awful happen to him, the lifestyle itself is incredibly unsupportive of dual-career families. I feel like I have it easy – at least I’m not also in the military! But frequent moves and deployments mean flexibility was a must, even if it came with a pay cut I’m just now earning back.

When my first child was about a year, my husband felt called to ministry. This necessitated him going back to school full time. Since I had worked some, and kept up my experience in the health care field, I was able to get a part time job that was enough to support us. I highly recommend maintaining earning power!

I don’t disagree with the focus on earning potential, but, I find it odd in our modern world how we often focus on earning potential rather than savings. I know a few people who are now stay at home moms but whom had their kids late after many years of working as engineers while living simply…from private conversations I know their savings would support their families for many years, and sometimes indefinitely (assuming a 4% withdrawal rate, and not fully addressing the huge wrinkle that is health insurance). Obviously, this isn’t the approach that’s going to work for everyone (I wanted to have kids young, for example), and work has it’s own rewards and pleasures, but, I’m surprised it isn’t mentioned more often in conversations about vulnerability and working.

@Allison – I don’t think savings and earning potential are at odds. Preferably, one has both! The one thing to keep in mind is that in a divorce, savings would likely be split, so one would only have half as much. And ideally, neither party would be using the bank accounts without consulting the other person as the marriage was falling apart, but…if the marriage was falling apart, that’s not a given.

This is a great point, esp if you have 2 working partners in a couple that eventually intends to have kids, or travel full-time or whatnot. At my very first job, I worked with a guy who was maybe 27 who had already decided that he and his wife would retire at 40 and every decision he made was towards this. I think they eventually planned to have kids (I didn’t stay in touch) but they also wanted to live and travel all over the world. So while we were eating our $40 steak dinners with our per diem as consultants, he was eating PB&J and saving that per diem every single day. I totally didn’t get it then, but now I do 😉

Wow! What an amazing story– All the scenarios where a partner needs to be available to still make money. When you said- children need both money and time– very true.

Sadly, I’m experiencing the opposite with a friend of mine.

She was in a good job and moved with her husband and kids to another city to plant a church.

She couldn’t get a transfer from her company (the head office is in this city) so gave up her job and (this was a mistake and if I’d known at the time, I would have cautioned her otherwise) took out her pension (what you guys call a 401K, I think?). Things went well for a while but long story short, two years ago they went through a horrible divorce and she had to go out and get a job.

The 7 years in ministry are seen as nothing because her field is actually banking, and she had to take a very low position just to try make ends meet.

It’s very, very sad to see her basically starting all over again in a city with much less earning potential (her kids are in school there so she’s reluctant to move back).

I like that you framed the discussion in terms of ‘earning potential’ and exploring the in-between solutions a bit. I am lucky to have worked in the tech industry for most of my career where there are a LOT of job openings for my skillset. I have yet to have been penalized for my 18 months off, my 4+ years of part-time work or my 2 year stint as a remote contract worker, so I’m hopeful that the current time off I’m taking won’t hurt (much) despite the fact that we’ve moved somewhere with fewer job opportunities. I made sure to renew my project management certification and am working on my LinkedIn profile and my resume. I’m a planner (and a worrier) by nature, so I still worry about whether this is all “enough”, but I really try not to live in fear of what might happen. For our family, having us both work full time outside the home just doesn’t lead to the kind of life we want. Doable, but not enjoyable. I’m not sure where I’m going with this comment, exactly 😉 but I think just like it is possible to make all the pieces fit and have a full life, it’s also possible to prioritize something else over work for a season (or several) and then figure out how to re-enter the workforce. Like anything there will always be risk, and sometimes the best laid plans go awry. But I don’t see your friend’s story as a reason to keep working full-tilt because something *might* happen, only that one should keep it in the back of your mind that you might need to pivot fairly quickly back into paid work and being the sole breadwinner. It’s kind of a fine line between doing something you don’t want to do out of fear, and being prepared for unexpected situations.

@ARC- some fields definitely penalize more or less than others. In general, if you have highly in demand skills, getting back in will be easier than if you don’t. There are many ways to live, and certainly full time work isn’t for everyone. But the possibility of needing to provide for yourself and dependents should always be in the back of your mind, as you said.